Currently you don't have any items added to your cart. Select some items then come back here to complete your purchase.

Go to shopWe believe every community, however remote, should have the essentials for life.

Find out more

Follow MAF's life-transforming adventures and latest developments from around the world…

Find out more

Great guests. Real stories. Lives transformed. MAF's The Flying For Life Podcast

Find out moreIf you are a church or religious organisation who would like to share more stories and images about the work of MAF, then in this section you can find ready-written material, prepared by the MAF UK News team, for you to download and use.

Find out more

The easiest way to give to us is online. Your gift can help us provide support to those in need.

Find out more

What’s involved in working overseas for the world’s largest humanitarian air service?

Find out more

For over 75 years MAF has been bringing help, hope and healing to the remote communities of the world. Pilots, engineers, managers, IT technicians, teachers, administrators and many other professionals have come together to bring transformation to remote communities.

Find out more

Answers to some of the most common and important questions about working with MAF.

Find out more

Come us find us at various events around the UK this year. We'd love to meet you and tell you more about the amazing opportunities to train and work with us.

Find out more

We are seeking to enable aspiring aircraft maintenance engineers to join MAF and work overseas. If you’re successful, we will help you achieve the theoretical knowledge and practical experience necessary to obtain an EASA B1 or B2 licence. You will then go on to serve with MAF in various programmes across Africa and the Asia-Pacific region.

Find out more

Have you got what it takes? If you’re successful, we will help you achieve the theoretical knowledge and practical experience necessary to obtain a Commercial Pilots Licence and a Command Instrument Rating. You will then go on to serve in an MAF programme in either the Africa or Asia-Pacific region.

Find out more

Over the years, hundreds of men and women have answered God’s call and set off on the adventure which is MAF!

Find out more

Help us to tell others about the need for more people to serve with MAF with this selection of recruitment posters

Find out more

At the heart of all we do is a desire to see isolated people changed by the love of Christ. Become an MAF Prayer Partner and be a vital part of our team. Partner with us in prayer today!

Find out more

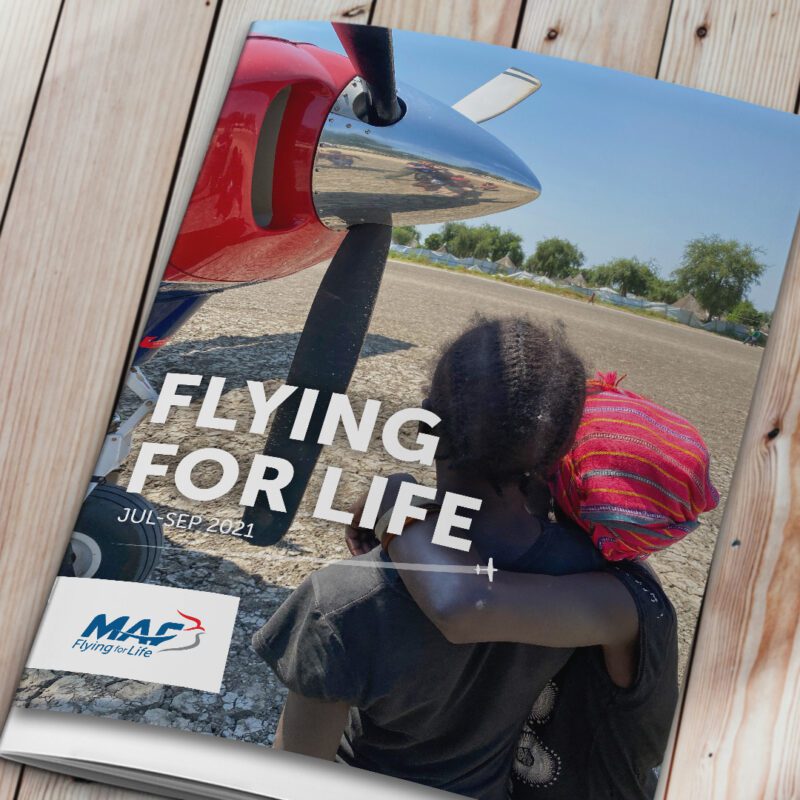

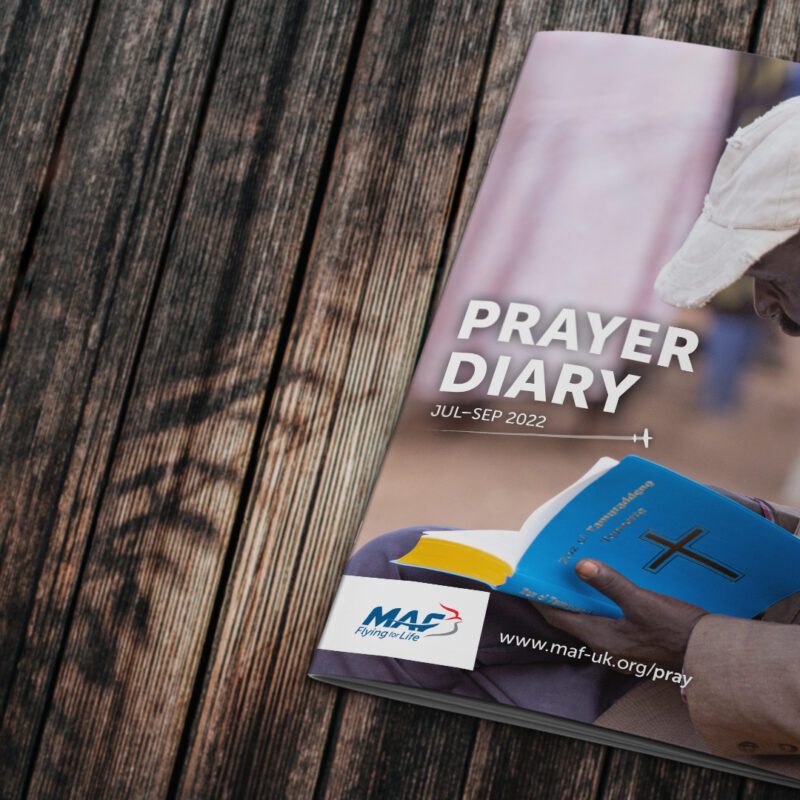

Our quarterly Prayer Diary includes daily prayer needs, photos and themed scriptures to equip you in intercession. As an extra bonus, the Prayer Diary comes with our Flying for Life Magazine - full of up to date stories from the countries in which we serve.

Find out more

Sign up to our new monthly prayer devotionals and join us spending time focusing on God and His wonderful works

Find out more

A prayer resource, emailed straight to your inbox, to encourage and inspire you in prayer

Find out more

A fantastic prayer resource that enables you to share the wider missional needs with your communities, inspiring and equipping them to take their stand and pray.

Find out more

At MAF we believe in the power of prayer. In fact, our prayers can go places that even our planes can’t. This prayer calendar enables our supporters to commit to praying for MAF and those we serve, from the comfort of their own homes. Book a prayer slot now.

Find out more

Pray with MAF for a hope and a future for some of the world’s most isolated people

Find out more

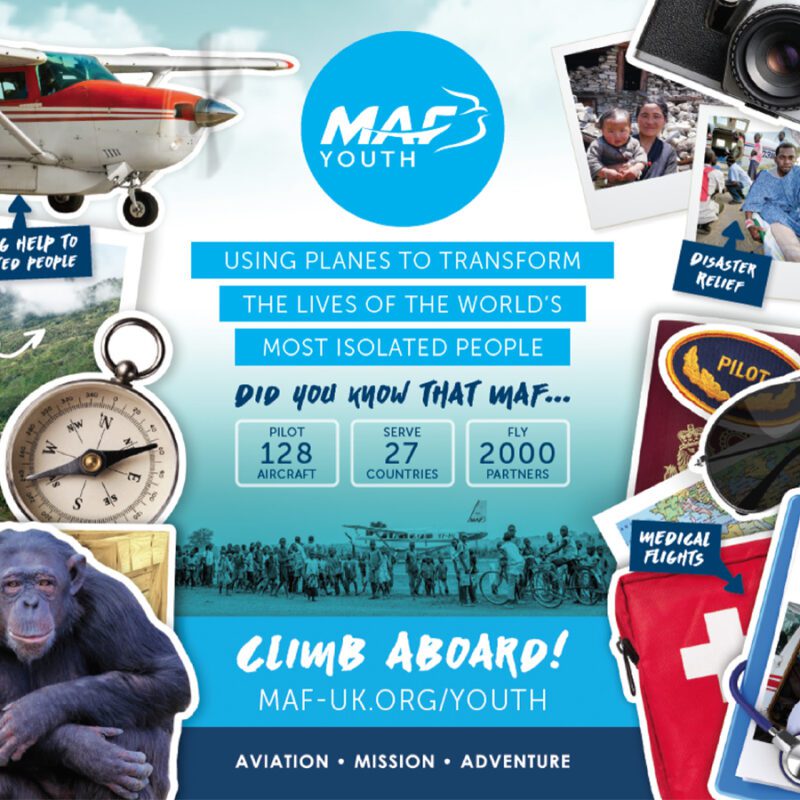

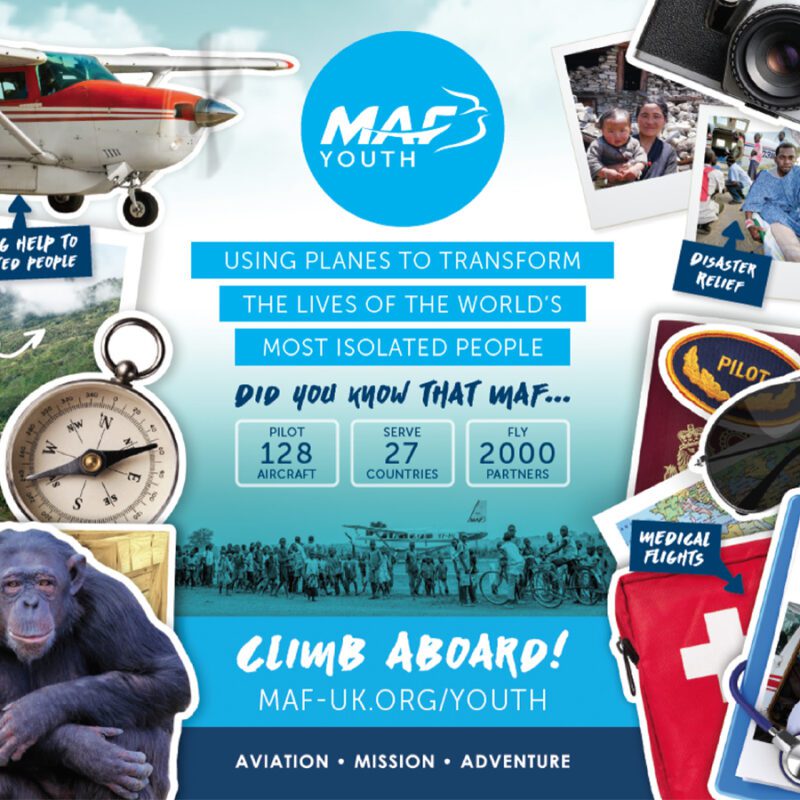

Check out our selection of great resources to bring the adventure of MAF right into your youth work.

Find out more

This exciting journey brings the countdown to Christmas to life, with a daily MAF story, fascinating facts about the different countries MAF serves, video clips, exciting activities, a competition with a grand prize, and much, much more…

Find out more

Have you got what it takes? If you’re successful, we will help you achieve the theoretical knowledge and practical experience necessary to obtain a Commercial Pilots Licence and a Command Instrument Rating. You will then go on to serve in an MAF programme in either the Africa or Asia-Pacific region.

Find out more

We are seeking to enable aspiring aircraft maintenance engineers to join MAF and work overseas. If you’re successful, we will help you achieve the theoretical knowledge and practical experience necessary to obtain an EASA B1 or B2 licence. You will then go on to serve with MAF in various programmes across Africa and the Asia-Pacific region.

Find out more